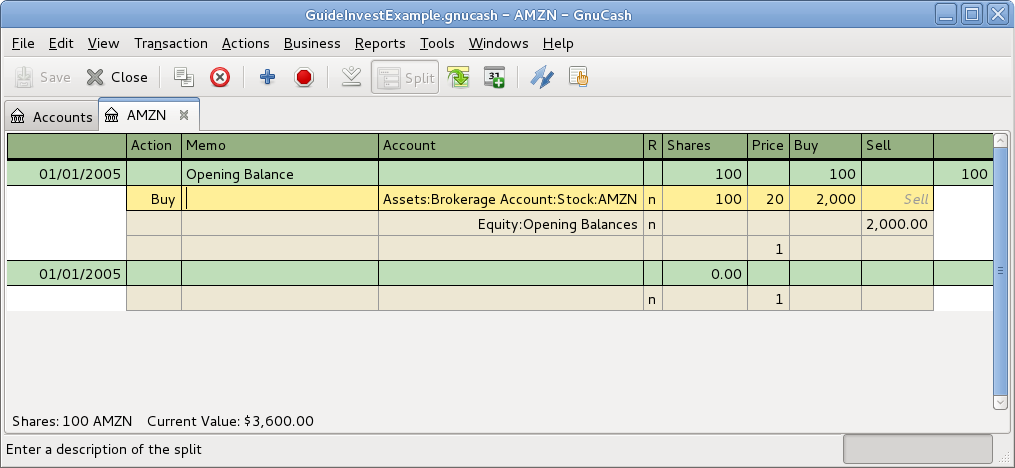

The examples in this section use Transaction Journal view.

To register the initial 100 shares of this stock that you purchased

previously, on the first (transaction) line, enter the date of the purchase (for example,

Jan. 1 2005) and Description (for example, Opening Balance). On the

first split line, enter 100 in Shares, delete

the (unit) Price (it will be calculated when you Tab

out of the split) and enter 2000 in the Buy

column.

| Note |

|---|---|

It is also possible to use | |

Tab to the second split line, enter transfer from account Equity:Opening Balances. For simplicity, this example assumed there were no commissions on this transaction. Your AMZN Commodity view should now appear like this:

Notice that the Balance (last column) is in the units of the commodity (AMZN shares) not in currency units. Thus, the balance is 100 (AMZN units) rather than $2,000. This is how it should be.

The main difference between setting up a new stock purchase versus the setup for preexisting stocks as described in the previous section is that instead of transferring the money used to purchase the stock from the Equity:Opening Balances account, you transfer from your Assets:Bank ABC or Assets:Brokerage Account account.

For conciseness, this document will refer to the money you pay to a broker for buying and selling securities as Commissions. Government fees may also be payable. Unless otherwise stated, fees are handled in a similar way.

In GnuCash 2 alternate ways can be used to handle commissions (for simplicity this document section

will refer to these ways as net pricing and gross pricing).

- Gross Pricing

You enter the price not adjusted by commissions and enter the commissions expense on a separate split in the transaction. This enables the tracking of commissions but is not compatible with using Section 9.7.2, “Selling Shares with Automatic Calculation of Capital Gain or Loss Using Lots”. Scrubbing doesn't know to deduct commissions and fees from the gains, so capital gains or losses must be manually calculated (see Section 9.7.1, “Selling Shares with Manual Calculation of Capital Gain or Loss”).

- Net Pricing

You enter a net price (adjusted by commissions) when buying and selling securities. You do not also record commissions in a specific commissions account in order to later claim it as an expense, as this would be claiming commissions twice. This way is compatible with using Section 9.7.2, “Selling Shares with Automatic Calculation of Capital Gain or Loss Using Lots”. This results in a slightly misleading price being added to the price database (the effective price you paid) but is not usually of any concern.

Please get professional advice if you are unsure which of these ways are applicable to your jurisdiction.

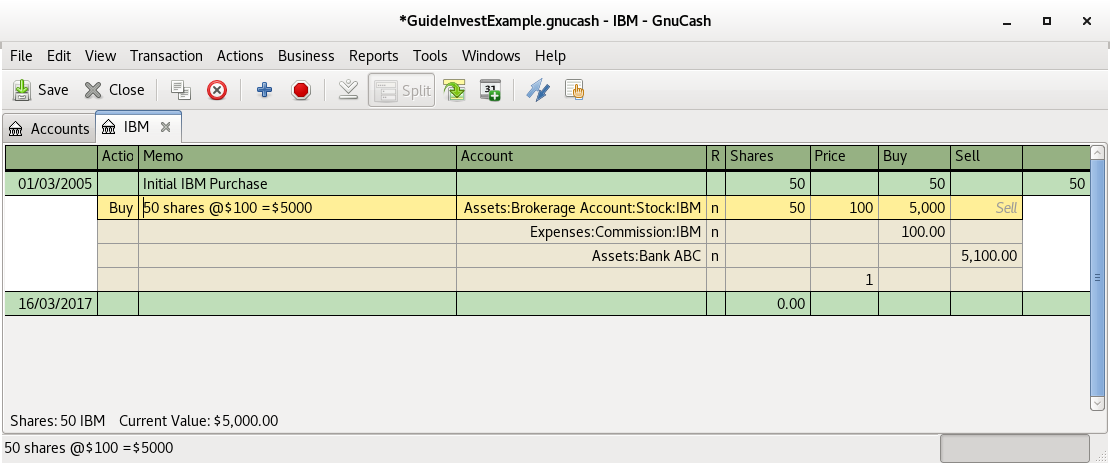

In this example you will purchase 100 shares at $50 per share of IBM stock with a commission of $100. First step will be to create the stock account for IBM. The existing Expenses:Commission account will be used.

Now for the transaction, on the first (transaction) line, enter the Date of the

purchase (for example, Jan. 3, 2005) and Description (for example,

Initial IBM Purchase). On the first split line, enter 50 in

Shares, delete Price (leave it empty so it will

be calculated), and enter 5000 in Buy. You do

not need to fill in the Price column, as it will be calculated for

you when you Tab to the next split. The next line in the split

transaction will be Expenses:Commissions and fill

100 in Buy. The third split line will be to

transfer $5,100 from Assets:Bank ABC account to balance the

transaction. Your IBM Commodity view should now appear like this:

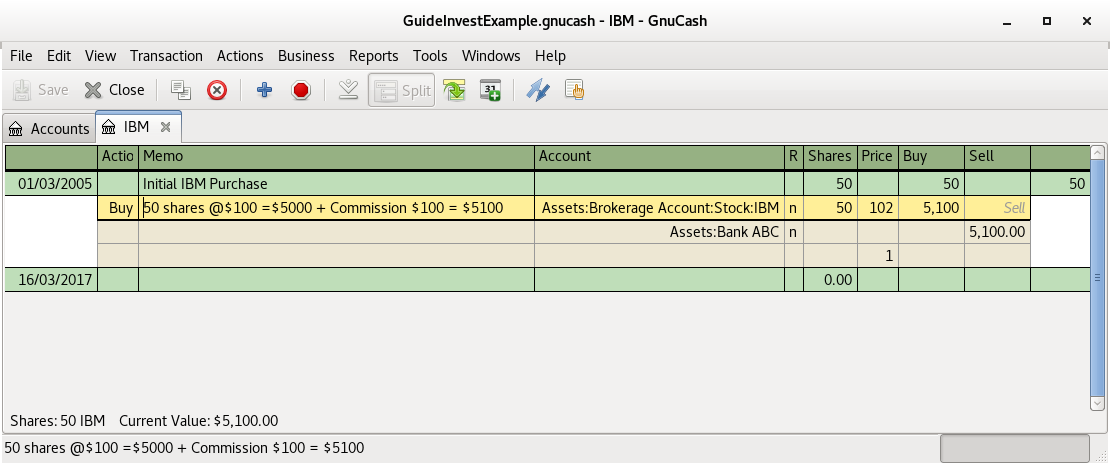

Repeating the previous example using Net Pricing instead of Gross Pricing, in Transaction Journal view.

Purchase $5,000 of IBM stock being 50 Shares for $100.00 each, plus a commission of $100.

Now for the transaction, on the first (transaction) line, enter the Date of the

purchase (for example, Jan. 3, 2005) and Description (for example,

Initial IBM Purchase). On the first split line, optionally enter more details in

Memo , then 50 in Shares,

delete anything in Price (so it will be calculated by dividing

Buy by Shares when you Tab out

of the split), 800px0 in Buy (50 * $100.00 + $100). Alternatively

use GnuCash to calculate Buy by entering the formula 5000 +

100 or (50 * 100) + 100 in Buy (

Buy will be calculated when you Tab out of the

column.) Use the Tab key as many times as needed to proceed to the next

split.

Do not enter a separate split for Commission as it has already been included in the Buy value. The second split line will be to transfer $5,100 from Assets:Bank ABC account to balance the transaction. After the splits are all correct, use the Enter key to save the transaction. Your IBM Commodity view should now appear like this: